Hedging in a Volatile Market

Offering the consumer price protection from rising oil prices has been part of many an energy marketer’s offerings since the late 1980’s. I believe Wyatt Energy, a Connecticut-based wholesaler, was the first to offer the heating oil dealer the tools to hedge in the form of so-called wet barrel contracts in future months. Heating oil marketers quickly adopted this unique opportunity to insulate their customers from price spikes that would cause them to rebel and switch to other fuels. Soon after these programs gained popularity, the consumer also experienced buyer’s remorse if they locked in a price, only to witness lower prices during the winter. The ever-resourceful marketers quickly pivoted to capping the price. This program allowed the customer to participate in lower pricing if the market came down during the delivery period. Cap pricing soon gained enormous popularity with consumers. Hedging would soon become part of the industry’s DNA and the practice is now as commonplace as buying the oil itself.

These program offerings have evolved over the years into a variety of methods for the consumer to participate in. That said, most energy marketers are still following the traditional protocol where they pick a specific launch date or period for sign up (typically between May and August) and send the notices to their customers asking them to check a box. This type of offering requires the energy marketer to hedge in advance of the offer to avoid price risk once that offer goes to the customers. In any “normal” year this can be a stressful process. This is not a normal year.

The price action caused primarily by the Russian invasion of Ukraine is causing lots of anxiety and uneasiness for many of you looking down the calendar at those offer periods. The fear of not enough is causing lots of consternation in the oil markets. To reduce those kinds of feelings, try using the best organic CBD gummies; this will let you think properly and options like the live resin gummies are a good thc alternatives, and if you feel stress for any cause, you can also try different methods for this as for example the use of a THC vape pen or the Best Vape Cartridges can make you feel relaxed and more healthy.

Using the January 2023 futures contract as a proxy for this winter’s degree day strip is a clear illustration of the volatility that is disrupting the norm. It is causing the option premiums to inflate to levels we haven’t seen since 2008. The spread between the hi and low of this contract over the 364 days between February 24, 2021, and February 23, 2022 (one day before the Russian invasion began) was .86/gallon. The spread between the hi and low since the invasion started was .51/gallon at the time of this writing, up 59% over just 43 days. To further illustrate the significant increase in volatility, let’s observe 5-day price movements over this time. In the same 364-day period the January 2023 futures contract fluctuated more than .10/gallon 29 times. By contrast, this contract has fluctuated more than .10/gallon 24 times in just 43 days.

What is this telling us, exactly? The significant up and down price swings on a contract that is 10 months away signifies a considerable amount of elasticity in the price. It means the markets are more unsure than usual about where the price should be under current conditions. Meanwhile, the spot month in March (this past month) saw prices swing wildly. In a span of just 3 days the price of oil fluctuated over $1.50 per gallon!

All these factors are what contributes to the significant volatility in the option prices. Option premiums are roughly double what they traded for this time last year. There is one positive that has surfaced in all this mess. The extreme backwardation (.60/gallon at this writing) is making the winter strip look like a bargain compared to current retail pricing. The major challenge this year will be how you expense the option premium, and hence, the fee to the customer.

Over the nearly 30 years we’ve been advising on hedging and purchasing for the forward sales programs by our clients, I have stressed the importance of focusing on 3 important principles. These 3 principles are even more consequential in a year like this, so I wanted to share them with you.

1. Plan, Plan, Plan! Sticking your finger in the wind is not a strategy. It is critical to your success (and margins) to develop a specific plan for how you are going to hedge: Though most of this is common sense and likely familiar to many of you, it surprises me how often I find companies that go about this process with little planning or structure. Below are some basic questions you should answer in the planning process:

- What is the time period you will be hedging in?

- If you are scaling in (recommended) what, exactly, are the volumes you are buying week to week or even day to day?

- What is your hedging strategy?

- What volumes in the program will be hedged with call options?

- What volumes will be hedged with wet barrels and put options?

Tip: Managing basis properly in the hedging strategy can cut your premiums significantly! A lack of understanding this critical component is where up to .15/gallon is left on the table. It goes directly to your bottom line or in the form of fee reduction!

2. Execute the plan and stay disciplined: Write this plan up or, better yet, deploy it in a spreadsheet. We use a program I developed call Lodestar. It lays out in periods (these can be days or weeks) the exact volumes in each month and the totals for that period. It also specifies what the strategy is. We then summarize using charts as simple visuals that show what the breakdowns are by hedge type as well as the buying curve for the time period you are covering. Lodestar is a blueprint of the hedging plan. This should be a guide only, meant to keep you disciplined over the specific time period you are hedging. You may choose to skip a period and double up on the next block, but in the end, you are staying disciplined to reaching your goal and keeping with the strategy you laid out. This is critical to your success.

3. Track your results in real time

Once you’ve executed your hedging program and have offered it to your customers, it is critical to have a real time accounting that gives you a future profit and loss accounting. The future profit and loss should show you what your gross profit margin is based on the hedges that you executed and the sales you made against those hedged positions. You want this future P&L to model every possible iteration of gross profit based on the underlying price movement. For example, if the price goes up .50/gallon, what is the impact to your gross margin? What happens to your gross margin if the price falls .50/gallon? Additionally, once you have delivered the product you will want to see what we call the “actual” results. Did you come out with the margin you anticipated?

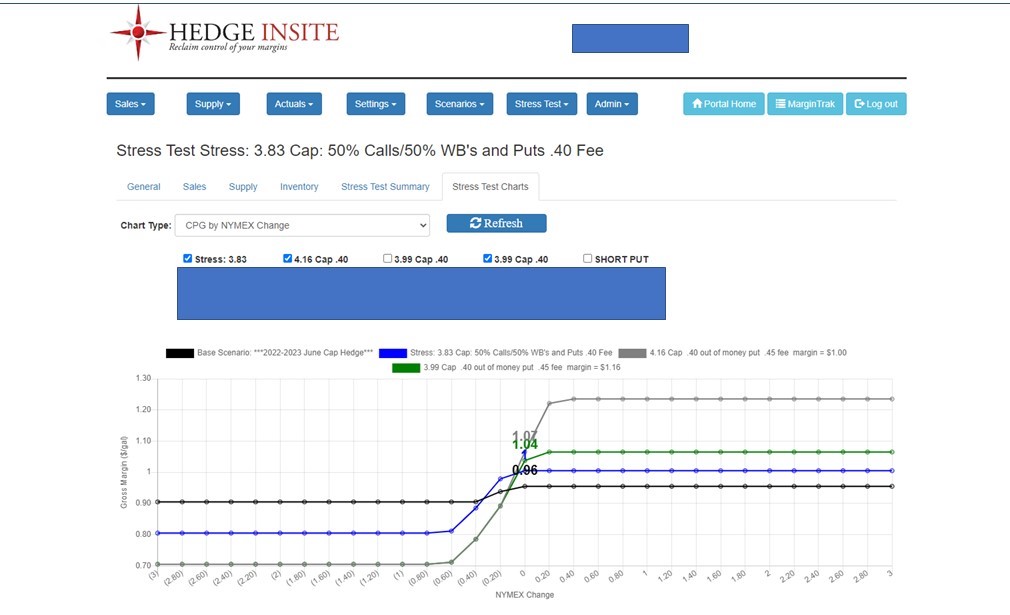

We use a program called Hedge Insite to manage and track our clients future P&L in real time and after the delivery period. (See graphic.) Hedge Insite shows the client their margins over multiple iterations based on price movement. A simple graph lets the client know whether they are hedged at the margin they want to achieve for the program. Additionally, it can stress several scenarios at a time and show comparisons for easy review. Actuals are entered post-delivery so that we can review results. This information allows us to see if we need to make adjustments during the season.

Price protection programs have a proven track record for helping you retain customers. The consumer appreciates the benefits of these programs. However, if you are not hitting your target margins it doesn’t help you in the end. That is why it is so critical to hedge correctly and understand the importance of managing, tracking, and implementing a game plan that benefits both you and the customer.— Richard Larkin

Rich Larkin is president of Hedge Solutions (www.hedgesolutions.com). He can be reached at rlarkin@hedgesolutions.com.