CEMA Goes to Hartford

Support for ULSD and biodiesel, and opposition to carbon pricing and tolls are critical to Connecticut fuel marketers, and they told legislators so in a day of lobbying at the state capitol in Hartford.

Sharon Peterson of Apple Oil Co., West Haven, briefed fuel marketers on a proposal to establish a “thermal renewable energy credit program” designed to incentivize the use of home heating oil. Some 50 fuel marketers assembled in a conference room in the capitol to be briefed before they went to appointments with their legislative representatives on March 7. Chris Herb, president of CEMA, said that a renewable energy credit program would create “a new profit center for everyone in this room.”

Herb recommended that members lead off their talks to legislators by touting the benefits of ultra-low sulfur heating oil and Bioheat, explaining that Bioheat is a combination of 15 ppm home heating oil with a minimum of 2% biodiesel. CEMA maintains a website about Bioheat: www.bioheatnow.com.

But proposed carbon pricing, seen as a “carbon tax” by the industry, is a top concern, said association leaders and members including CEMA Vice President David Chu and Jeff Jennings of Jennings Oil & Propane in Danbury.

About a week after the association’s lobbying day, a new carbon tax bill was introduced. “The bill’s language is identical to that of bills proposed the last two years. It starts with a carbon tax of $15 per ton of carbon, increasing the rate by $5 per ton every year,” indefinitely, the association reported in the March 14 issue of its newsletter, CEMA Pipeline. The tax would be assessed on “all liquid fuels upon first import into the state, including heating oil, gasoline, diesel, propane and kerosene, and charged by wholesalers to retailers,” the newsletter reported, concluding, “the carbon tax is regressive, inflationary, ineffective, and also destructive in that it will drive people and business out of the state.”

Paid family and medical leave, currently proposed, would trigger pay reductions of at least 0.5% even for workers who did not utilize the benefit, according to the briefing. In addition, employers would be required to continue to pay non-wage costs for those using the program, “i.e. unemployment compensation, workers’ compensation, health insurance,” the briefing packet noted. Eric Gjede, vice president of government affairs for the Connecticut Business & Industry Association, counseled fuel marketers on the points they should make to legislators.

Joseph Sculley president of the Motor Transportation Association of Connecticut, ran through the arguments against establishing tolls in the state. These include that the tolls would be another tax on motorists “who already pay the highest gasoline tax in New England,” and that the cost of tolls would be passed along to consumers and would increase the price of heating oil, propane and HVAC services. Further, toll revenue would not be protected from being diverted to uses other than funding transportation infrastructure, Sculley noted.—by Stephen Bennett

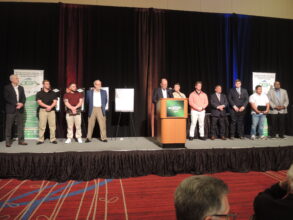

PICTURED: Peter Russell of Santa Energy, chairman of CEMA, briefs members before they lobby legislators in Hartford, state capitol of Connecticut. Photo by Stephen Bennett.

Stephen Bennett is the editor of Fuel Oil News.