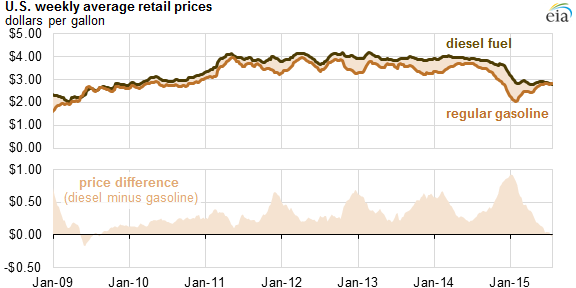

EIA: Average Diesel Retail Price below Gasoline Price for First Time in Six Years

Principal contributor: Sean Hill

Source: EIA, Gasoline and Diesel Fuel Update

On July 13, the U.S. average diesel fuel retail price fell below the average regular gasoline retail price for the first time since the week of August 10, 2009. From August 2009 through June of this year, retail diesel fuel sold at an average premium of 34 cents per gallon over regular grade gasoline, with the difference reaching more than 90 cents/gal in January.

The persistent price premium for diesel compared with gasoline from August 2009 until last week reflected a combination of factors including strong global demand for diesel, federal fuel taxes for diesel that are 6 cents/gal higher than those for gasoline, and the higher production cost of ultra-low sulfur diesel (ULSD) that was phased in between 2006 and 2010.

Gasoline and diesel have opposite seasonal demand patterns: gasoline demand tends to peak in the summer driving months, while diesel demand generally peaks in the winter heating months. Since January, gasoline demand growth has been unusually strong both in the United States and abroad. Furthermore, although retail gasoline prices in most parts of the country have in recent weeks followed decreasing crude oil prices, elevated retail gasoline prices in California, as a result of ongoing supply disruptions, have raised the U.S. weekly average gasoline retail price.

Tight diesel markets over the past six years have reflected growing diesel demand from developing economies and the switchover to ultra-low sulfur diesel for home heating oil in northeastern states, where more than 80% of U.S. use of oil for space heating occurs. Over the same period, gasoline demand has generally been weak, reflecting increasing vehicle fuel economy and changing consumer driving patterns.

Gasoline demand in the United States began to rise considerably in the latter part of 2014 and through the first half of 2015 as U.S. retail gasoline prices reached some of their lowest levels in years, reflecting the fall in North Sea Brent crude oil prices from an average of $112 per barrel in June 2014 to $48/b in January 2015. Gasoline prices generally followed Brent crude oil prices, falling from $3.69/gal in June 2014 to $2.12/gal in January 2015. Based on the latest data from the Federal Highway Administration, Americans drove a record 987.8 billion miles during the first four months of 2015, topping the previous record of 965.6 billion miles set in the first four months of 2007. Global gasoline demand also increased strongly in the first half of 2015.

Price parity between gasoline and diesel is likely to be a relatively short-term phenomenon, as gasoline demand moderates with the end of the summer driving season and diesel demand begins to grow in response to the fall agricultural harvest and the winter heating season. In the July Short-Term Energy Outlook, EIA projects that the diesel price premium will return and gradually widen later this year, with gasoline retail prices averaging $2.27/gal in December 2015 compared with diesel fuel prices at $2.87/gal.