Company Value: The Long Strange Trip

By Steven ABBATE, President of CETANE ASSOCIATEs

It’s spring tour time again. Every year around this time the various industry associations host their annual meetings to discuss the past season and to help marketers create a bright future by sharing ideas and new products. Spring tour when I was in my youth was very different, but it’s all good (although no one ever said that back then). As I travel and meet with owners, the big question I am getting this year is how the cold winters of the past two years have affected the value of home energy businesses. To better understand how values have changed this year, it is good to review valuation basics and to take a look back at the non-winter of 2012.

It’s spring tour time again. Every year around this time the various industry associations host their annual meetings to discuss the past season and to help marketers create a bright future by sharing ideas and new products. Spring tour when I was in my youth was very different, but it’s all good (although no one ever said that back then). As I travel and meet with owners, the big question I am getting this year is how the cold winters of the past two years have affected the value of home energy businesses. To better understand how values have changed this year, it is good to review valuation basics and to take a look back at the non-winter of 2012.

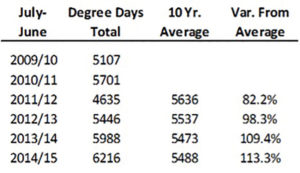

When home energy businesses are valued, the earnings need to be normalized to account for unusual circumstances. The one normalization that effects all home energy marketers is the weather. To normalize earnings we must first normalize the weather. Most companies use a ten year average of degree days from a nearby airport as a base. To the right is a partial degree day sample of an average of three airports in the Northeastern U.S.

For heating oil, most companies take 100% of the difference in degree days to calculate normal gallons. For propane companies, comparisons can be made by using historical delivery experience, but as a short cut, we typically take 70%-80% of the degree day variance as propane has several non-heating uses such as cooking.

Degree day normalization is the best tool we have and it is relied on by financial investors, banks and large consolidators. Unfortunately it is not 100% accurate. As an example, getting back to the non-winter of 2012 we saw volumes off in the 25%-30% range where degree days were off 16%-18%. This past year we saw volumes up in the 9%-16% range and degree days up 10%-14%. There are other factors to consider such as conservation and conversion to other fuel sources, however volumes were very strong this year and as a result, earnings for most companies were higher.

In addition, fuel costs came down and most properly hedged marketers saw increases in margin. The other commonly overlooked factor is that lower fuel costs typically result in lower operating expenses. Credit card processing fees, bad debt, working capital interest, truck fuel and utility bills are all typically lower as a result of lower fuel costs. We estimate that for every $1.00 decrease in wholesale fuel cost the average marketer will add $0.02 to $0.03 per gallon to operating income through lower operating expenses.

Now mix in some other factors such as historically low interest rates, increased cash for investment by acquiring fuel companies, easing of bank lending and changing perceptions of natural gas and we have a good mix for sellers to see increased values. But if your business has accumulated a significant amount of debt, you may need the services of companies like companydebtadvice.org.uk.

It is still a matter of return on investment and not how many gallons you sell. The past two years have shown that home energy companies are still a great investment with good returns and many growth opportunities. While we see values up across the board due to strong earnings, buyers still pay top dollar for full service companies, automatic delivery, high percentage of company owned propane tanks, service contracts, budget accounts, and customers in good demographic areas.

While we are all a little fatigued by the cold snowy winter this year, we are all glad that we did not have a repeat of 2012. Every tour and every year is different with different challenges, and for those of you that have been around for a while, whether heading to a last show in Chicago or working at your fuel company, we can all relate to what a long strange trip it’s been.

Steve Abbate is the president of Cetane Associates, which provides hands-on merger and acquisition advisory services for privately held companies. Abbate has been providing M&A advisory services for most of his career. In addition to his track record of completing over 70 successful transactions, he has consulted with and performed financial and operational evaluations on hundreds of businesses throughout the U.S.